Trump wants to tax the Gates Foundation? Good.

....but Bill Gates and other oligarchs will probably still come out ahead under the Republican tax plan

For months the news media has reported rumors that the Trump administration appears poised to challenge Big Philanthropy—perhaps revoking the non-profit status of some liberal foundations, or taking steps to limit their donations to foreign countries.

The latest story to circulate, which takes the form of actual legislation, is that the Trump administration wants to start taxing billionaire philanthropies.

As Politico reported last Friday, the largest American philanthropies “would get hit with a whopping 10 percent tax on their investment income” under a new tax plan being advanced by Republicans.1

Personally, I would describe a 10-percent tax as weak, not “whopping.” It’s far less than most individuals and corporations pay (or are supposed to pay).

The most prominent target of the proposed tax is the Gates Foundation. The wealthiest American philanthropy, the foundation boasts a $76-billion endowment, which generates billions of dollars in investment income most years—virtually tax free.

The foundation’s most recent financial filings—-from 2023—show that the Gates Foundation generated almost twice as much money from investment income (a truly whopping $11 billion) as the foundation gave away in charitable grants ($6 billion).2 In so far as the Gates Foundation appears to be in the business of making money, not just giving it away, why not tax, regulate and scrutinize it the same way we do with other investors?

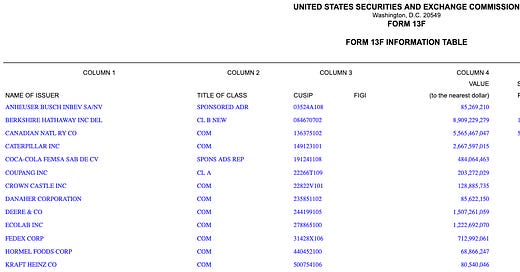

Here’s a partial list of the massive financial stakes that the Gates Foundation currently holds in companies around the world—again, on a virtually tax-free basis:

As the chart notes, Bill Gates’s private foundation has a $12 billion stake in Microsoft, the company Gates co-founded. Separately, Bill Gates has a very large personal financial investment in Microsoft (one estimate is $28 billion). However, Bill Gates and the Gates Foundation are taxed differently on their Microsoft holdings.

Gates’s personal investment gains (barring legal loopholes and tax avoidance) should be subject to a tax rate around 20 percent.3 The Gates Foundation, meanwhile, currently only pays 1.39 percent.

This discrepancy in tax rates creates perverse incentives for Gates, and other billionaires, to transfer their wealth to philanthropy; doing so shields it from taxation. Keep in mind, once Bill Gates donates his wealth to the Gates Foundation, he continues to control how it is spent. For all intents and purposes, it’s still his money, but it now sits in a tax-privileged bank account. Is this arrangement somehow worthy of massive tax benefits?

Over the last 25 years, the Gates Foundation has generated tens of billions of dollars in investment income on a virtually tax-free basis. That represents a large loss of tax revenue for the United States. And it presents one more way that billionaires are not paying their fair share.

It also means the Gates Foundation has been able to grow in size, wealth and power—something I documented in a chart I published with my first-ever investigation into Gates in 2020, in The Nation:

The trend profiled in the graph above has continued. Actually, it has accelerated. The Gates Foundation’s wealth has grown by around 65 percent since 2018, which is very difficult to square with the foundation’s supposed raison d’etre: giving away money.

If the foundation had been paying a 10 percent tax on its investment gains that entire time, this would have, to some extent, limited the foundation’s wealth accumulation.4 But is a 10-percent tax sufficient? Is it the right approach?

It’s such an inconsequential number that I almost wonder if it’s a compromise that Trump and Gates—or Trump and some right-wing philanthropists—worked out together behind closed doors. (Gates and Trump have met personally at least twice in recent months.) The tax allows Trump to look and seem like he’s doing something, but, in practice, it has little effect on billionaire philanthropy. Or at least no real, significant effect on Gates.

My own view is that we need far more imaginative and radical solutions. In the same way that there is growing debate around abolishing billionaires, we should also be debating abolishing billionaire private foundations—recognizing that philanthropies like the Gates Foundation have become too big and too powerful, and are a threat to democracy.

There should be limits imposed on the total wealth a private foundation can control—because money is power. As one of many alarming examples, Bill Gates’s money-in-politics brand of philanthropy has allowed him to radically, undemocratically reshape childhood education in the United States, as reported in the Washington Post and Common Dreams.

In the hands of someone like Bill Gates, billionaire philanthropy is not clearly serving the public or unburdening taxpayers. It’s more like an exercise in oligarchy. That means we need to move way beyond a 10 percent tax and consider bigger remedies aimed at unraveling this unaccountable, undemocratic body.

While Donald Trump, more than any other political figure in history, appears positioned to potentially challenge Gates—something I first wrote about last year—it’s not at all clear that Trump can or will directly confront the Gates Foundation, or do so in a meaningful, constructive manner.

The currently proposed tax on billionaire philanthropies, for example, is only a tiny piece of a much larger tax plan that will probably enhance the wealth of the oligarch class—including Bill Gates himself. During Trump’s first administration, he pushed through a tax plan that richly benefited the super wealthy. And while his new tax plan has generated a lot of buzz around the possibility of a ‘millionaire tax,’ that appears to be more hype than reality.

The reason I write so much about Bill Gates is because he’s such a good case study for the problems of extreme wealth—and because he’s the biggest obstacle to tackling oligarchy in the United States. But, at the end of the day, he’s only a case study. The larger political project we should engage in is not dismantling the Gates Foundation; it’s dismantling extreme wealth and oligarchy in all of its forms, whether it trades under the name of Musk or Gates or Bezos or Zuckerberg.

I’ll end this piece by repeating what I wrote in my first piece about the Trump-Gates nexus, back in 2024:

Liberals will spend the next four years mocking and ridiculing Trump, but they should be focusing this energy on creating a viable alternative to challenge him—a political platform that is actually progressive, that, for example, is willing to aggressively re-organize our economy to end extreme wealth. This, necessarily, means challenging Bill Gates and the Gates Foundation.

In a sober, rational world, Congress would have, long ago, worked in a bipartisan manner to limit and regulate the Gates Foundation, to prevent it from becoming so large and powerful—-if for no other reason than because of how fragile the foundation’s influence is, and how much liability it presents. Just as a practical matter, isn’t it obvious that it’s a bad idea to allow a billionaire, who has no constituents or mandate, who is subject to virtually no checks and balances, to have so much influence? What happens when this billionaire changes his mind? Or if he suddenly dies? What happens when the political tides radically change—-when a disrupter like Trump is elected?

We’re about to find out.

It appears that the proposed legislation in the House targets the 10 percent tax at foundations with more than $5 billion in assets.

Investment income is taken from the Gates Foundation Trust’s audits; the Gates Foundation’s charitable grants are taken from the foundation’s IRS 990. A fuller explanation of methodology can be found in my book, “The Bill Gates Problem.” In the book, I calculated that between 2003 and 2020, the Gates Foundation paid out $59 billion in charitable grants while netting $48.5 billion in investment income.

The tax rate Gates pays on investment income—through the capital gains tax and net investment income tax—depends on his income and the length of time he holds an investment. It may not be exactly 20 percent. It’s also worth stating that Gates has an army of financial advisors who can help him find legal loopholes to minimize his tax bill.

Bill Gates has also become much richer, with his personal wealth growing from around $90 billion in 2018 to between $112 and $168 billion today, according to Forbes and Bloomberg estimates.